Business models: Rapid rate of change

But signs of change are becoming apparent, and in particular three major business model shifts have emerged:

- As digital technology allows more accurate measurement of value, services companies are increasingly charging for value-add rather than for tangible products or software packages.

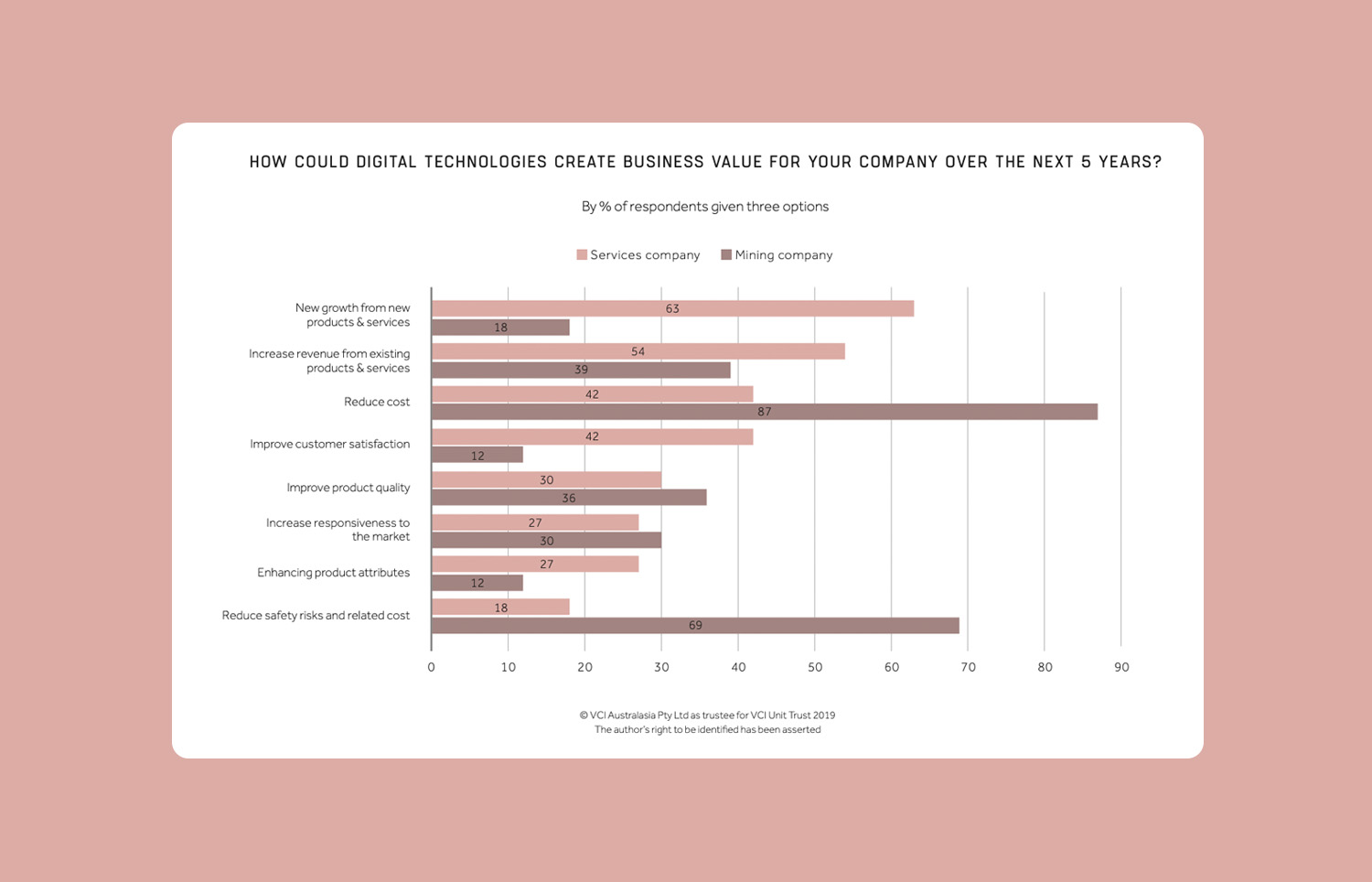

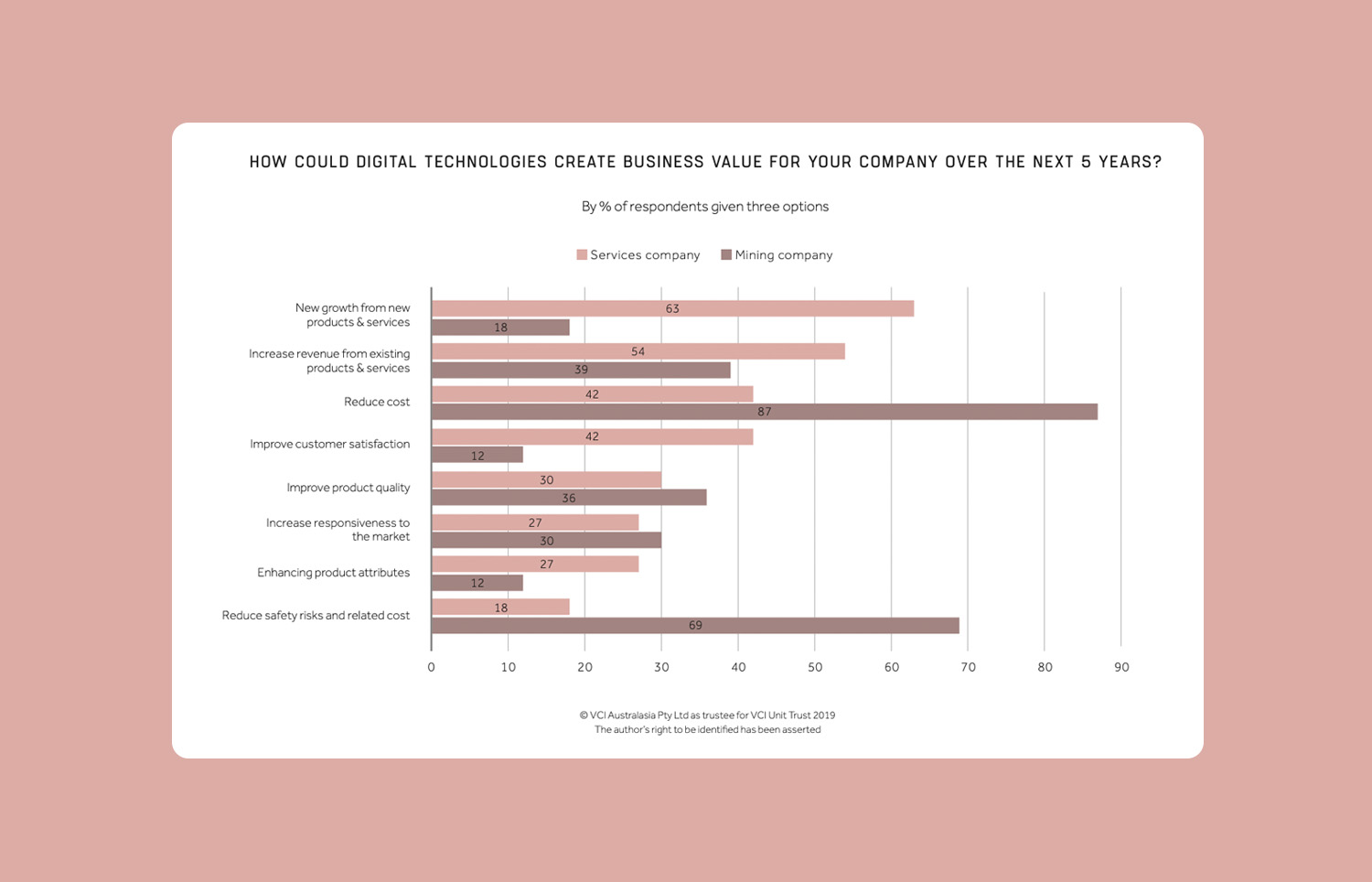

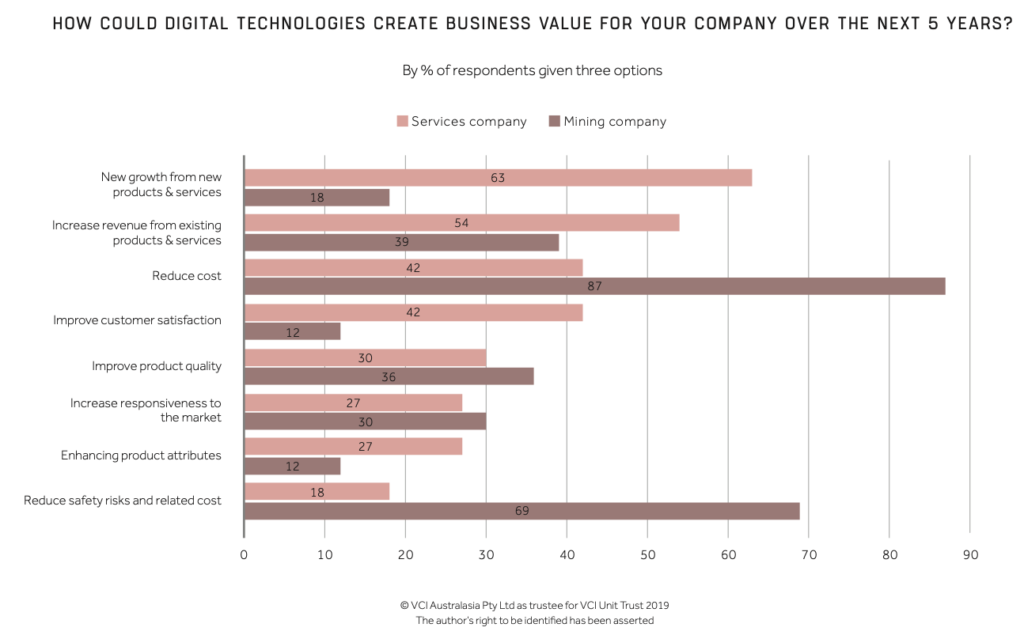

New growth is seen by services companies as the number one new opportunity in digital technology - Technology-driven transparency of social and environmental performance is causing some companies to see provenance of products as a potential competitive advantage.

Environmental concerns are likely to be the second biggest disruptor to the global mining industry over the next 15 years. - While mining has traditionally believed “bigger is better”, we are starting to see a shift toward smaller, autonomous fleets which provide more efficiency and flexibility in operations.

Automation are likely to have the biggest technological impact on mining over the next 15 years

“We need to differentiate technology for technology’s sake from technology to support your business model. When you get the business model right, you then ask what technology can do.”Mining Company CEO

Shifting the services goalposts

Servitisation, whereby services companies charge per unit of performance, is a trend across industries including heavy industries such as mining. Digital retail has been at the forefront of this trend with models such as recurring subscription fees for unlimited access, and charging fees relative to usage, disrupting product-based competitors. There are generally two models:

- Recurring subscription fees for unlimited access

- Charging fees relative to usage

In transport industries, higher quality manufacturers are also increasingly turning to servitisation business models. Rolls-Royce and Michelin were early pioneers here, leasing engines and tires respectively for free, and instead charging customers a fee per-mile-travelled.

The advantages of servitisation business models are that:

- It incentivises suppliers to focus on the quality of outcome not just to reduce cost

- Customers have better certainty over costs and supply chain logistics

- It requires more accurate sensing, which also enables prescriptive maintenance

- Customers can focus on core capabilities and outsource non-core functions

- It requires lower invested capital and so assets do not sit as large liabilities on operators’ balance sheet

Servitisation enables the best skills to be pooled in highly innovative services companies to provide an outcome rather than a product. Miners, in particular mid-tiers and smaller companies are increasingly likely to outsource to specialised providers to reduce costs and deliver better results. Consequently, this sector of the mining industry is more likely to open up opportunity for innovative services start-ups. Ultimately, remote or fully virtual operations centres could be mostly staffed by multiple service providers who specialise at each step of the value chain.

“We partner with people every step of the value chain and we use their profit drivers to incentivise them.”Infrastructure company CEO

Going back to the roots

The provenance of a product refers to the entire production process; where it came from, who produced it, who supplied its production and how it was transported. As social expectations rise and the mining industry is increasingly tied to consumer-facing industries (e.g. consumer technology, electric vehicles etc.), the provenance of minerals can be a source of competitive advantage.

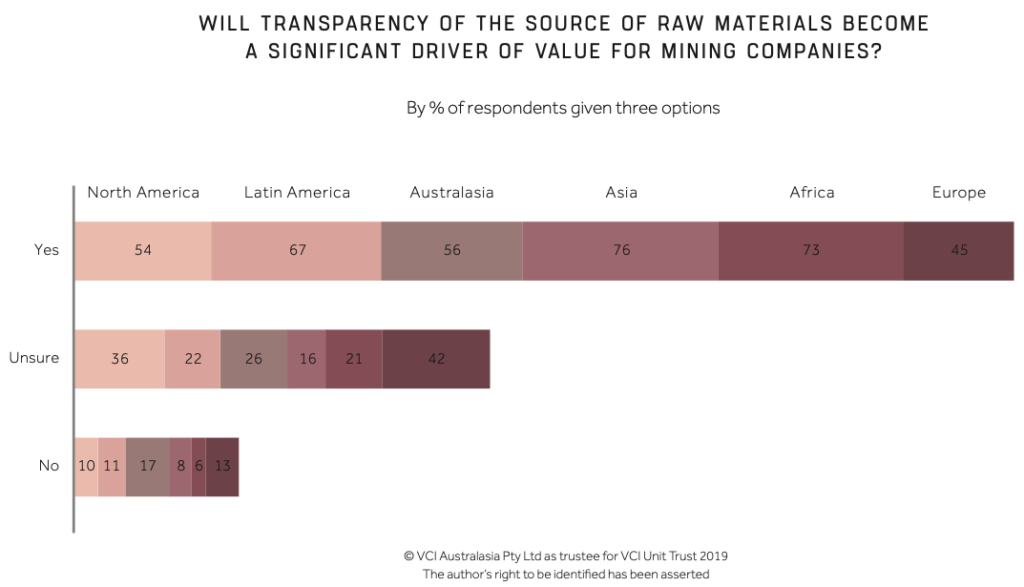

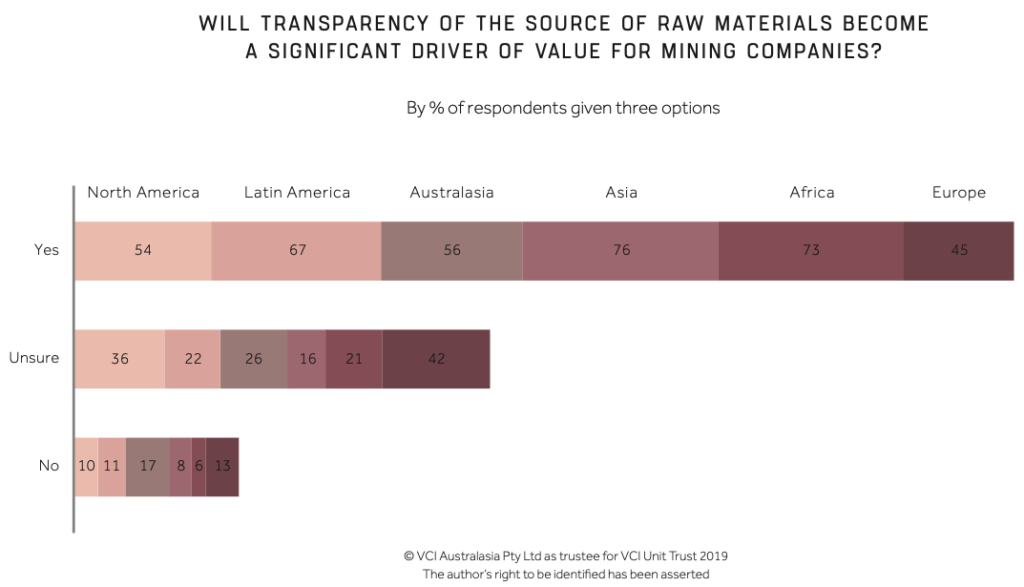

While most respondents viewed transparency of raw materials as a significant value driver for mining companies, it was particularly those who operated in developing countries (76% of Asian, 73% of African and 67% of Latin American respondents) who saw the biggest opportunity. Given these regions tends to have looser governance structures, seeing transparency as a value driver suggests it has the potential to drive significant innovation. Interestingly, Australia, which has arguably one of the most transparent operating environments globally saw the least value from transparency.

“Mining is so far away from the end use that mining companies think they’re immune to its impacts because they’re protected by the supply chain. They’re not.”Industry Group Executive

The value potential of provenance is well recognised and is currently being promoted by a range of companies for example; conflict free Tantalum by Global Advanced Minerals; “security of supply and auditable supply chain” by Clean Teq’s Scandium, Cobalt and Nickel project; and “green gold” offered by Valcambi.

It is still unclear as to how the provenance trend will play out. Will customers pay a premium for ethically sourced minerals (which to date has proven elusive), or will it simply become a regulated requirement to supply minerals?

Small is beautiful

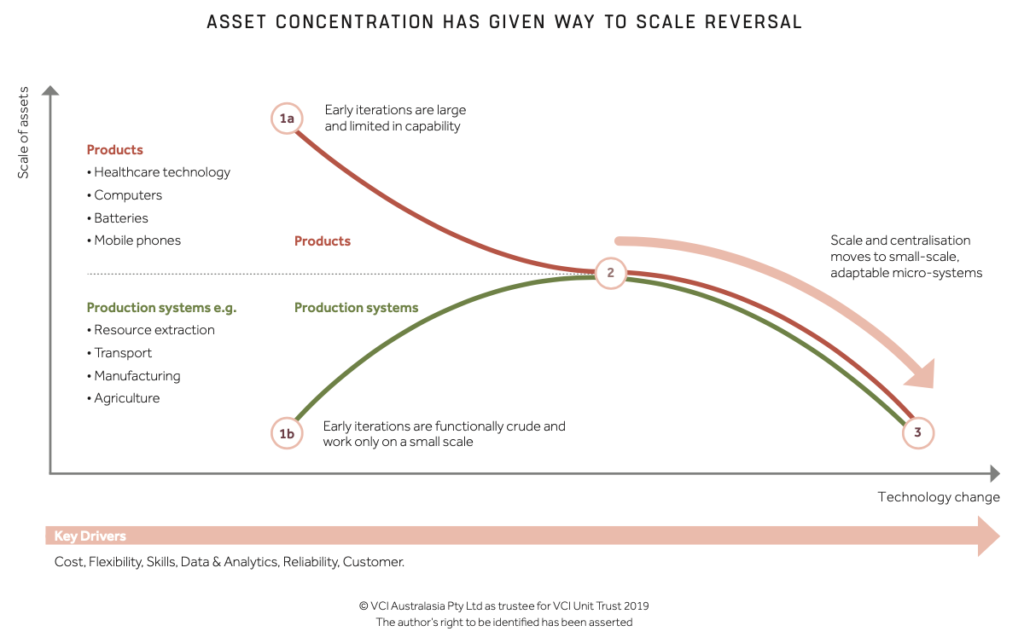

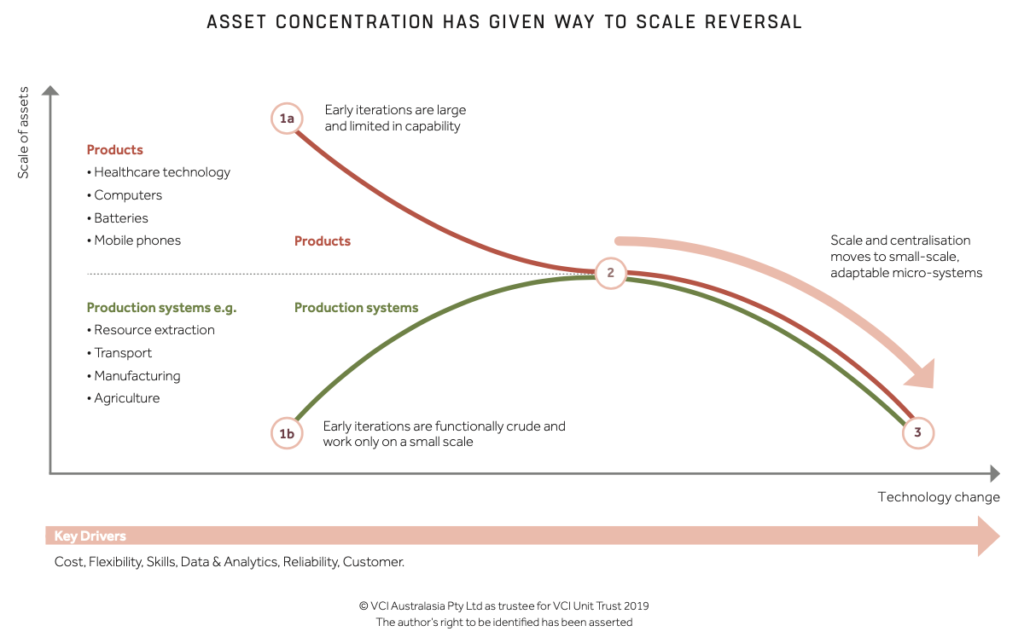

There are strong indications that the mining industry is reaching or has reached “peak scale” and that the future is likely to see a trend towards a larger number of smaller autonomous vehicles being deployed on-site. Scale reversion will be driven by a step change in technology, including automation; proliferation of the internet of things and automation; and materials and manufacturing. Bigger systems aren’t necessarily the most efficient, as manual involvement is no longer the key marginal cost in a more autonomous industry. Instead, operations may adopt a swarm approach; larger numbers of smaller autonomous fleets, which are able to dynamically respond to their operating context.

“Mining companies still rely on scale as their main source of competitive advantage – that isn’t where the world is going.”Industry Group Executive

In general, technology products have shrunk in size at the same time as their capability has improved. From computers to batteries to healthcare technology, smaller often means better. Industrial production systems, however, have tended to take advantage of economies of scale, getting bigger to become more efficient.

We believe the industry is approaching a tipping point. Economies of scale is no longer the driver of efficiency, flexibility and modularity may now be the key. Agriculture is a good example; farming yields are increasing as smaller, more precise farm management equipment improves productivity.

“What would the ultimate mine look like? Potentially an army of robotic wheelie bins where the design efficiency is monumental, both in open pit and underground.”Mining Company CEO

Modular, autonomous sites, working on a smaller scale also changes orebody viability. Smaller deposits suddenly become economic, changing the supply profile for especially non-bulk commodities. In addition, these new operating models present compelling improvements to operational expenditure and safety.